What Customer Churn is and How to Calculate it

Last updated on August 25, 2022

If you work at almost any modern company, or a dairy farm, chances are you’ve heard the term churn. Though it is only one word, it can have a different meaning depending on the industry you are looking at- in the world of agriculture a churn is a device used to turn cream into butter!

However, if you’re in the business world, churn is referring to something completely different. In this article, we’re going to cover that type of churn: the kind that relates to customers and won’t raise your cholesterol. Along with giving a (business) definition of customer churn, we’ll also give you some handy formulas to calculate customer churn rates. Lastly, we’ll give some tips you can use to try and reduce churn at your company.

What is Customer Churn?

When someone says a customer churned, what they mean is that they either canceled their business or decided not to renew an agreement they previously had. To put it simply: it’s any business that you lose. All businesses deal with churn. For some, it’s not as important a number. For others, it’s one of the most important metrics they have.

For example, a gas station probably isn’t as concerned about customer churn as a subscription business is. Both want to keep customers, but the nature of a gas station’s business is different and relies more heavily on volume, rather than repeat business from the same customer. Although it is becoming more and more common for convenience stores to have loyalty programs, which are meant to bring people back and reduce churn.

In the example of a subscription business, it matters much more because it generally costs them more to acquire a customer (this is sometimes referred to as CAC or Customer Acquisition Cost), so it takes longer for them to break-even or turn a profit on a customer. They need to put more effort into reducing their churn generally, to keep their business healthy. If they’re not able to retain a certain amount of customers, then they won’t be able to stay in business.

Another case where churn is something that is very important to keep an eye on is in businesses that have a small number of clients. For example, ad agencies might have two to three large clients that account for the majority of their annual business. Then they have a number of smaller accounts that round out the rest of their earnings. So if one of the big accounts churn it’s a very large problem.

However, that’s really only one part of the story, right? What if you lose one big account, but then add an account that’s worth the same amount, or even more? How do you measure impact in that case? That brings us to our next topic: calculating your churn rate.

Calculating Your Churn Rate

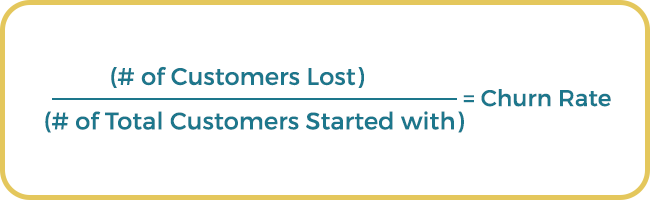

Typically, when talking about churn you’ll hear someone refer to their “churn rate.” In order to calculate your churn rate you need to first define a specific period of time. It could be a week, a month, or more.

After you’ve defined your time period you take the number of customers that churned and divide that by the total number of customers you had at the beginning of the time period.

So, if you started with 100 customers, but lost 5, you’d have a churn rate of 5%. Meaning that over that period of time only 5% of your customers churned. The actual equation would look like this: (5/100)x100 = 5

For another example, let’s say you started with 500 customers at the beginning of the month, but lost 35 over the month. The equation would be (35/500)x100. In that case, you’d have a monthly churn rate of 7%.

Here is the equation without any variables filled in so you can plug in your own numbers:

How to Calculate Churn Rate

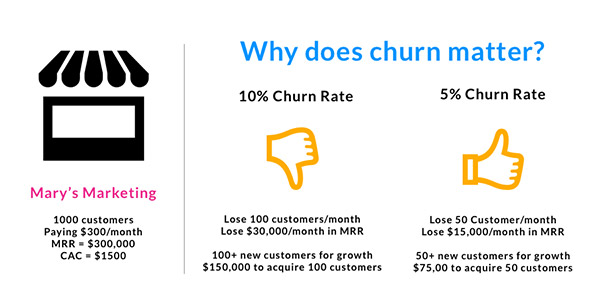

Being able to calculate churn rates is important because it allows you to measure the impact of different projects, or company initiatives. It can also help you determine progress for your business and give you benchmarks to measure against. While the actual number mightn’t explain much, it can be a really good starting point for you to start digging deeper.

Here is a great example from Proof showing how churn affects your business growth.

As we’ve mentioned, churn impacts some industries more than others. For some it’s not an important metric, but for others it’s a main health indicator. To give an example, online retail has a churn rate of about 22% in the US. However, SaaS companies aim for a churn rate of 5% or lower annually.

Strategies to Reduce Churn

Now that we’ve covered what churn is and how to calculate it, we’re going to talk about a few ways you can reduce churn at your company. Each industry will be different but most should find something relevant below:

-

Watch the Market – Have you ever noticed how industries have trends? For example, when smartphones first came out it seemed they were all priced at about $200. So when something was priced above that it seemed very expensive. That device would need to provide something super unique to justify the cost. It had to prove that the value was there.

Any product or service you sell follows the same rules. Even if someone loves your product, if they perceive that the cost is not worth the value it brings, then they will probably start shopping around for different options. Now, we’re not saying that you need to price-match everyone in your space. What we are saying is that if you’re the most expensive you do need to have a strong case as to why.

-

Invest in Customer Education – How many people do you know that own guitars? Now, how many people do you know that actually play the guitar? The number is probably quite different. Infact, 90% of those who purchase a guitar don’t play beyond one year. However, Fender found that the 10% that continued playing may spend up to $10,000 in their lifetime on guitars and related accessories.

Though your product is probably easier to learn than an instrument, there will still be an element of a learning curve involved. If a customer is discouraged early and not able to accomplish the task they wanted to with your product, chances are they won’t continue using it in the future and you’ll lose their business. Investing in education options like help center articles and online tutorials means customers will have a better chance to be successful with your product and be less likely to leave.

-

Look for Trends – When you analyze your churn data you may start to notice that most people leave within a certain timeframe. Or, perhaps you see that when a customer uses a certain feature or service that they are less likely to churn. These types of actionable insights are invaluable.

To use them to your full advantage, you need to go a step further and see if you can figure out why those things are happening. As many a math teacher has said, correlation does not equal causation. So, be curious and dig in deeper to learn even more about your customers and what may be motivating them.

Conclusion

Remember that to measure churn you need to first define a period of time, then you’ll take the number of customers lost over that time and divide it by the total number of customers at the beginning of the time period.

Though there is no silver bullet to stop customers leaving there are a few things to consider. Make sure you’re keeping up with the market. If your price and value don’t align, then it could cause trouble. Invest in educating customers. When they’re successful with your product, they’re more likely to stick around. Last, be curious about the data you gather. Look for trends and dive deeper to understand them.

You won’t be able to keep every customer you attract. It’s a fact of business, and one that you’ll need to prepare for. Though it is an inevitability, you can take measures to decrease those instances. Being able to identify customer churn is the first step in that journey.

To learn more about customer experience related metrics, check out this article: 6 Most popular customer experience metrics and KPIs explained simply